Check if you’re eligible and what you can claim

A guide to R&D tax relief, Patent Box relief and innovation funding grants

R&D tax relief, the Patent Box scheme and innovation funding grants are all designed to help set you on a cycle of innovation and IP exploitation so that you and the country can grow and prosper.

You may believe that you don’t carry out R&D or create innovations – you simply solve problems in your business as they arise. Yet there are plenty of activities SMEs carry out each year that qualify for tax relief or further funding. Or you may have put it off as it seems too complicated or time-consuming to bother.

Whatever the reason, you could be losing out on non-repayable funding that the government wants you to claim. Doing so helps you innovate and achieve their grand ambition for the UK to become the most innovative country in the world.

We’ve put together this guide to help you see what activities are eligible and how much you could claim.

Source: The UK Longitudinal Small Business Survey: SME Employers, UK- 2019

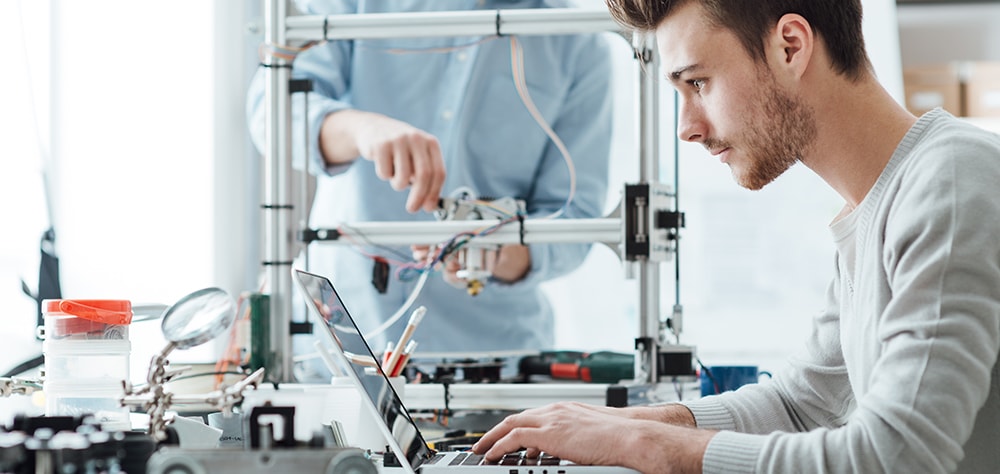

R&D tax relief

R&D tax relief is the government’s generous cash incentive for companies who have attempted to create new or improved products, processes, devices, materials or services. You can therefore claim even if your R&D activity is unsuccessful, so long as it qualifies.

The returns can be very generous – up to 33% of your qualifying project costs may be returned in cash.

What qualifies for R&D?

Your project must seek an advance in a field, science or technology, by resolving scientific or technological uncertainties.

The key test

Would a competent professional working in your field be unable to readily deduce whether the advance you’re seeking is feasible to achieve, or how to achieve it in practice?

It’s not enough to create an advance for your company alone. Eligible examples include:

Sector-specific examples of potentially qualifying activities

There are plenty of instances in which you may unwittingly be carrying out qualifying R&D activity whilst trying to find solutions to problems in your business.

How much can you claim for R&D tax relief?

How much you can claim depends on which R&D tax relief scheme your activity falls into. This depends on the size of your company and how your activity has been carried out or funded.

The SME scheme

Who it applies to

SMEs that have carried out their own R&D. SMEs must have a headcount of less than 500 and either:

What you can claim

The RDEC Scheme

Who it applies to

What you can claim

What counts as qualifying expenditure?

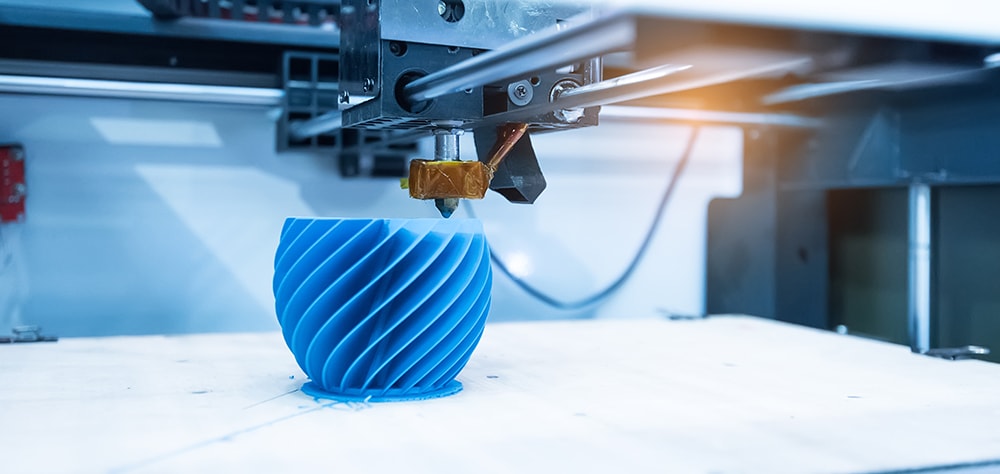

Patent Box Tax Relief

The Patent Box is a regime that allows you to claim a reduced 10% corporation tax on any profit you make for patented inventions – even if they form a small part of a larger product. The relief can provide you with extra cash flow for 20 years.

What patents qualify?

Any patents you’ve registered at any time are covered but they must have been granted by the:

Can you claim?

You can claim if you:

What qualifies as income?

The relief covers any income you make, whether that’s in the UK or worldwide. You can claim for income generated in the following ways:

Innovation Grants

Innovation grants are effectively competitions that you can apply for to help fund your R&D or get it to market. They run throughout the year and we will always explore whether you may meet the criteria. (Although, as it’s a competition, whether you are successful depends in part on how strong you are compared with the other applicants.)

There can be significant differences between funding programmes but most seek to support project concepts that:

In addition to the above, many funding calls also have additional specific criteria, such as: